Insurance

6 articles

Imagine that one night your house catches fire. You and your family escape unharmed, but by the time the fire is extinguished, there’s hardly anything left of the house or its contents. Once you recover from your shock, you call your home insurance company to file a claim. The company tells you that in order to

Most insurance types protect just one part of your life, such as your home or car. But an umbrella policy covers your whole life, protecting you from the types of life-ruining lawsuits that can happen to anyone. Find out if you need an umbrella policy before it’s too late.

Millions of employees save for retirement by deferring a portion of their compensation into an employer-sponsored, tax-deferred savings plan. The majority of these are known as qualified plans and fall under the jurisdiction of ERISA guidelines, which means they are subject to certain limiting requirements. For example, these requirements can pertain to the type and

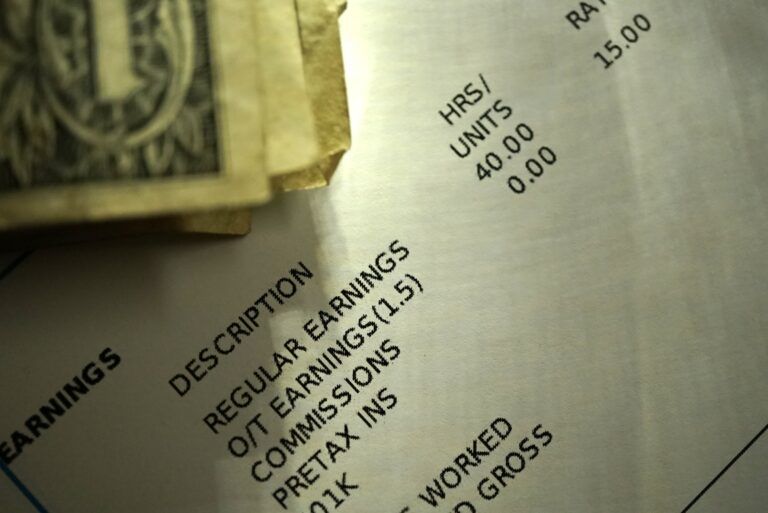

There are many occasions in which you may need to prove your income, whether you’re attempting to get a mortgage, auto loan, a new apartment, or a public welfare benefit. Read on to learn how to show proof of income from the most common income sources in a wide range of situations.

The last thing you want your family to worry about is paying the mortgage if you die. Life insurance can provide your family with the funds they need, but most mortgage protection insurance policies will pay off your entire loan should you pass away. Read on to learn which is right for you.

Liberty Mutual straddles the line between the low-cost, direct-sales model and the personalized, local agent-focused model many other insurers follow. It offers the best of both worlds, with a low-key, non-salesy experience. Find out the policies Liberty Mutual offers and whether it’s right for you.

Trending stories

Explore Protect Money

You don’t want to lose it. Learn how to keep it safe.