Whether you’re saving for an emergency fund, a down payment, or early retirement, sometimes it helps to know the doubling time for your current or initial investment if you were to stop investing new money toward it. Learn how to use the rule of 72 to quickly estimate how your investments will grow.

You searched for

High Interest Savings

12 articles

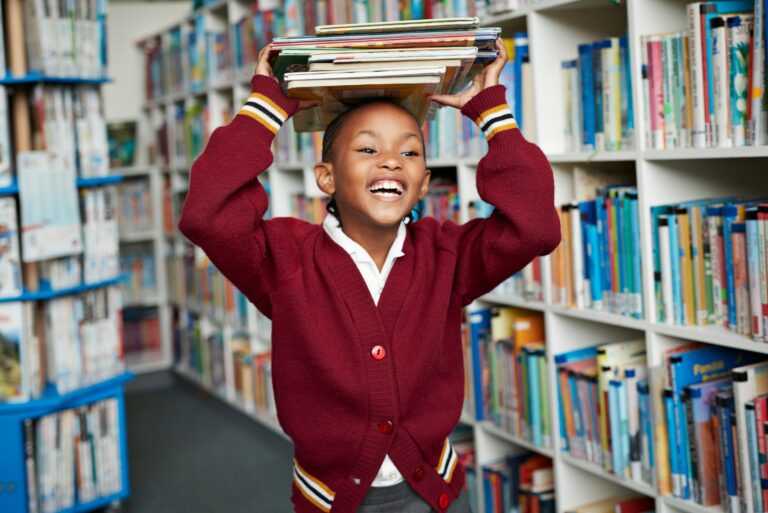

One of the trickiest jobs for parents is figuring out how to teach kids about money. A good book can help. There are lots of children’s books that introduce basic financial ideas in terms kids can understand. Learn about the best books that teach kids about money and promote financial literacy.

High student loan payments make it hard when emergencies like medical bills or car repairs crop up. Forbearance lets you temporarily pause your payment so you can use your money for other things. But it’s vital to understand what you’re getting into and carefully weigh your options first.

Lenders looking to minimize their risk often set minimum standards for how long you’ve met certain borrower requirements. As you shop for a home loan, keep these mortgage seasoning requirements in mind. Learn about the different types of mortgage seasoning requirements and how they work.

No matter where you went to college, one thing most graduates have in common is a significant amount of student loan debt. Trying to manage it all can feel overwhelming regardless of your financial situation. Whether you’re looking for a way to stretch a tight budget or pay off your loans faster, consolidation or refinancing

Most schools don’t do enough to prepare young people for financial independence. Parents can address this education gap with books about important financial topics, such as managing debt, building savings, and investing for the future.

Whether you’re going for an undergraduate degree or pursuing grad school, skyrocketing tuition costs mean few students can avoid borrowing student loans. To save the most money, it helps to borrow wisely. Knowing how to compare student loan options like repayment terms and interest rate types can save you thousands in the long run. But

Mortgage points give homebuyers the option to “buy down” their interest rates by paying a fee upfront. Does it ever make sense to pay more at the settlement table to reduce your interest rate for the life of the loan? Learn about how mortgage discount points work and when they make sense.

You can sit down and make a budget that covers all your regular expenses. But real life has a way of interfering with your financial plans. Learn about the most common types of unexpected expenses and how to plan for them.

Your 20s offer the best opportunity to build long-term wealth through compounding. Start young, and you can let time do the heavy lifting for you. Wait, and you’ll need to save exponentially more money just to catch up. Learn the keys to investing in your 20s.

No one sets out to fall behind on their student loans. But default comes with serious consequences, including wage garnishment, tax refund and Social Security benefit seizure, and damage to your credit report that could last for seven years. You may have heard of bill or credit card debt settlement, but is it possible to

Payoff is an online-only debt consolidation loan provider with a friendly, transparent approach to the dry business of making and managing loans. If you’re faced with high-interest credit card balances, Payoff is worth a closer look.